RED PENTAGON? DOD'S LENINIST L-BAND EXPROPRIATION TIPS LIGADO NETWORKS INTO BANKRUPTCY; FIRST DAY HEARING TODAY; LIGADO SEEKS REDRESS AND $40B

A ‘strategy of deceit and misinformation’ at the Department of Defense. Also today: Court to hear Russian Federation objection to Stoli cash collateral motion; oligarch’s ‘unlawful misappropriation’

So there’s no end to entertainment possibilities today: Ligado Networks, which filed Sunday thanks in no small part to the United States of America, specifically the Department of Defense. In a suit filed in October 2023, Ligado alleges that the U.S. expropriated and used spectrum awarded to Ligado by the FCC without compensation and then engaged in a strategy of “deceit and misinformation.” Ligado is suing the U.S. for $40 billion, reflecting sunk costs and lost revenues related to a proposed 5G network in the L-Band that the Pentagon took for its own. It filed for breathing space to focus on that lawsuit, among other things. More below. The first-day hearing is at 2pm ET.

Coincidentally, today is the final hearing in Stoli’s cash collateral motion at 9:30 a.m. ET. This hearing includes an objection filed by the Russian Federation, represented by Quinn Emmanuel. More here: Russia argues that the Stoli trademarks were “unlawfully misappropriated” during the post-Soviet “privatization.”

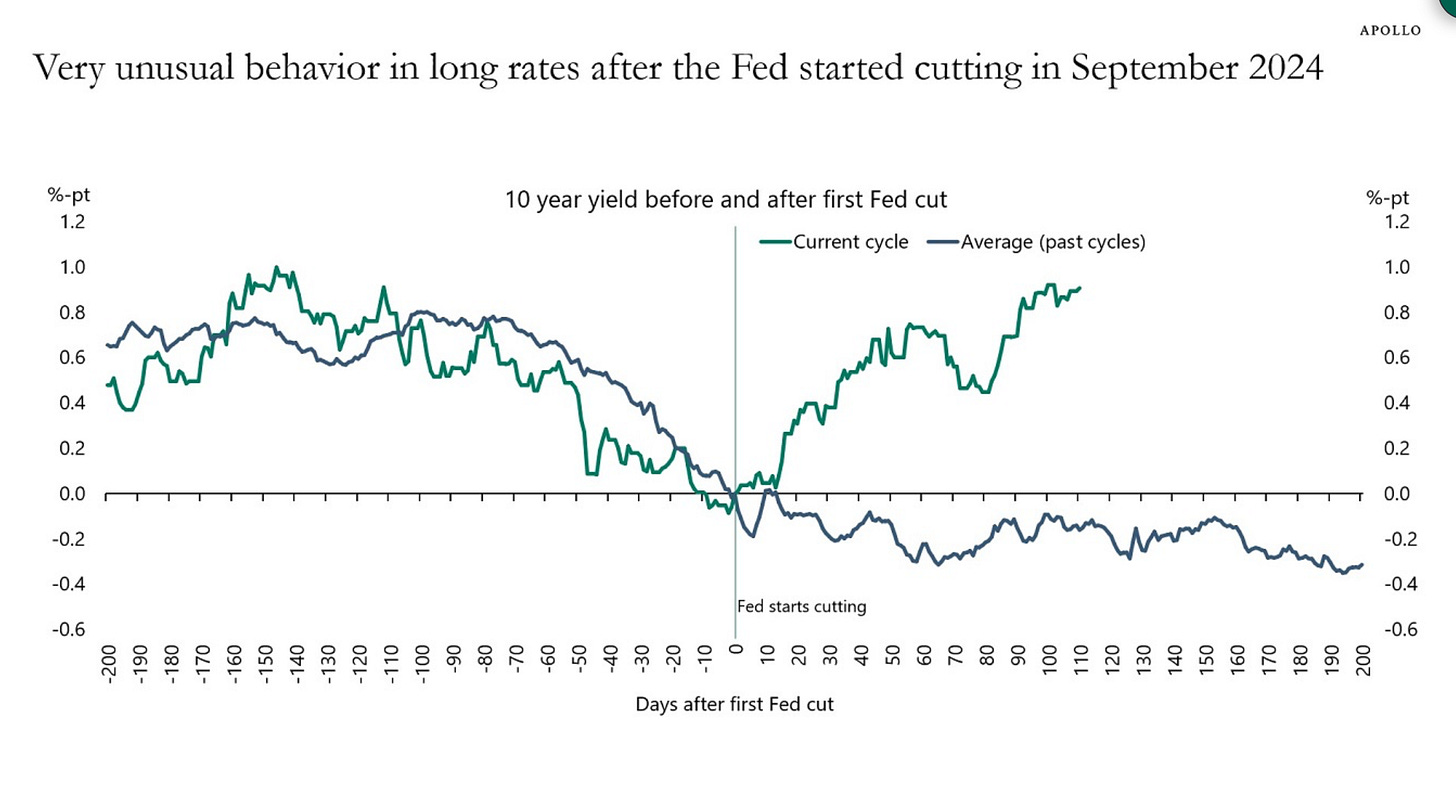

In the meantime: 10-year Treasuries are little changed, yielding around 4.65%. That’s the highest in over a year and comes after some nerve-wracking inflation data and Powell’s mid-December moan about “caution.” The Treasury is selling $99 billion of 3Y, 10Y and 30Ys this week; yesterday’s auction of $38b in 3Y was priced at 4.332%, tailing the 4.320% when issued bid. Indirect bidders, a proxy for foreign buyers, took down 61%, below 64.2% in December.

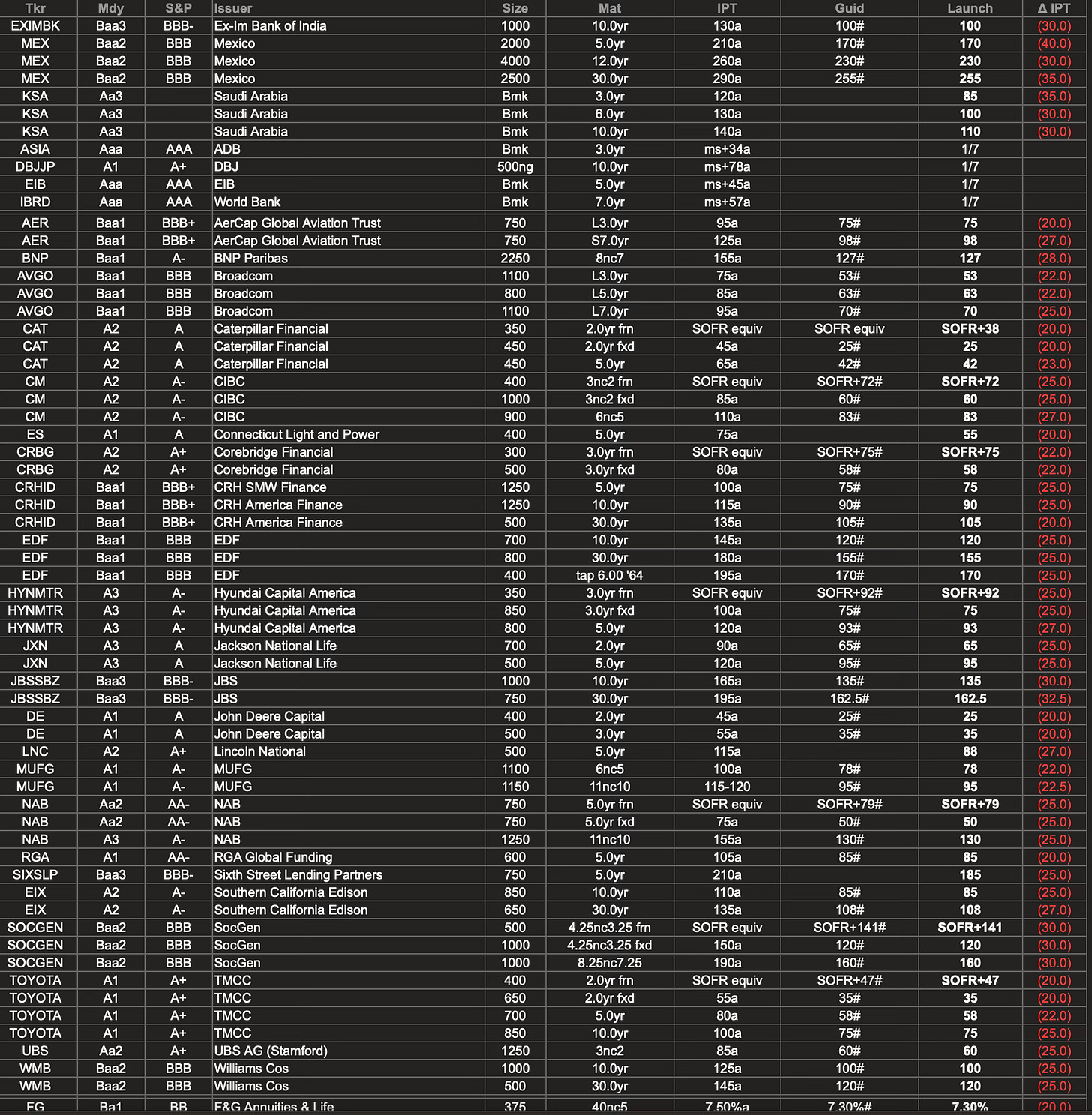

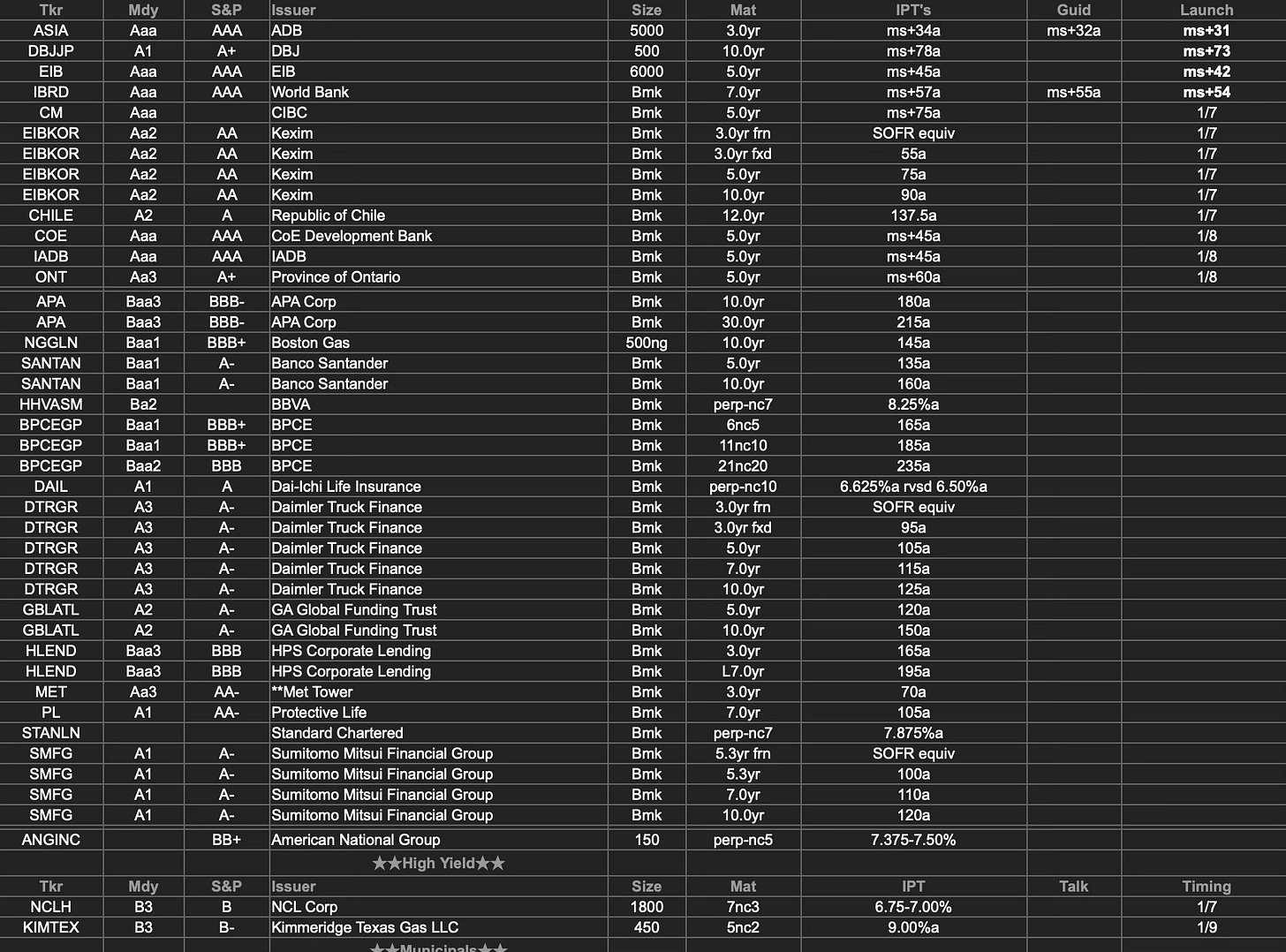

That’s not the best set-up for today’s $39b auction of 10Y notes. Is it the return of the bond vigilantes? Indigestion from the massive volume of corporate supply? Monday’s investment-grade issuance, which adds up to over $80b; Tuesday not as heavy, but it’s packed:

Or is it something else? Our favorite market observer, Apollo’s Torsten Sløk, notes that long yields usually decline once the Federal Reserve cuts rates. So WTF, for real:

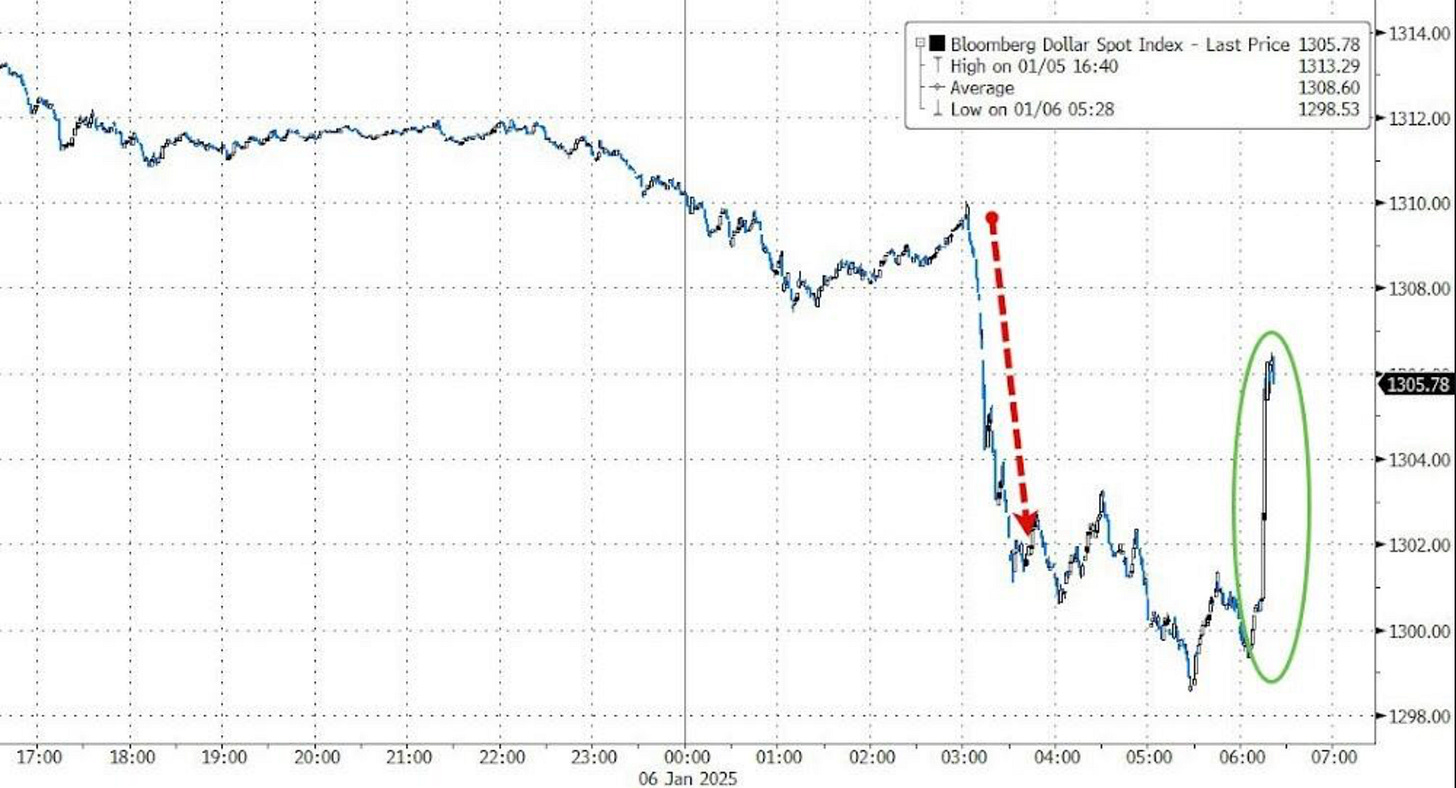

And finally. Yesterday, we linked to a story that first appeared in that Washington newspaper – the Newel? The Shaft? The one Amazon owns – suggesting the incoming administration’s tariffs would be way less onerous than expected. Trump has since disputed that claim: “another example of fake news.” We bring this up not because we are interested in the mud-slinging but because the dollar plunged on the news. Nice job, Shaft, or whatever you’re called.

And finally!

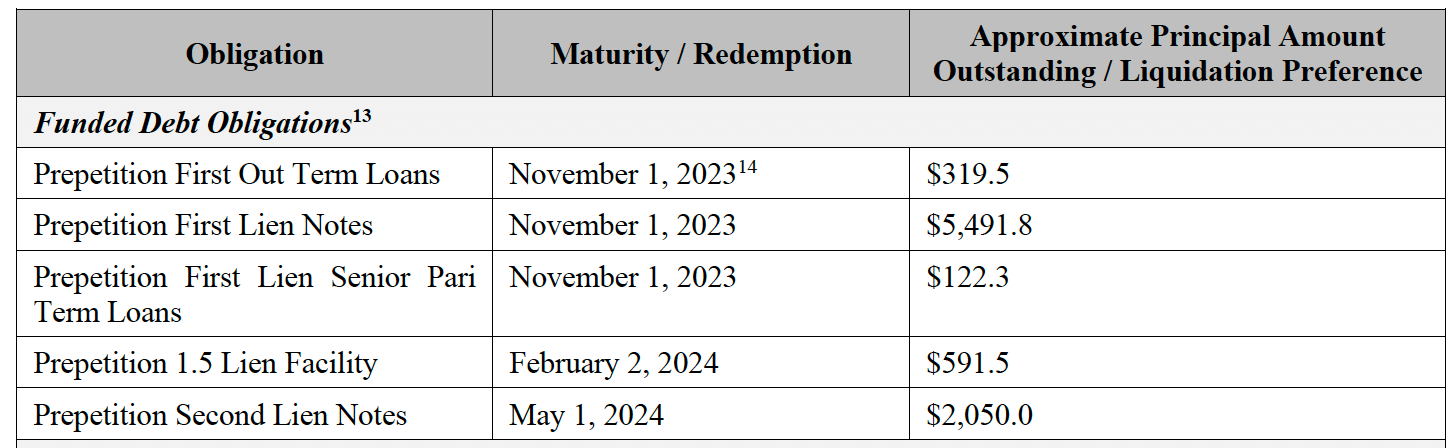

Ligado Networks, with ten affiliates, filed on Sunday, January 5, in the District of Delaware. The first-day hearing is Tuesday, January 7, at 2pm ET in Delaware before Judge Horan. Legal: Sidley Austin.Financial: Perella Weinberg Partners (“PWP”). Prearranged chapter 11/RSA supported by 88% of prepetition funded debt, including first lien and crossholder groups. Funded debt (it sums to $8.6 billion):

There are also series of preferreds (liquidation preference just short of $3b) and two classes of equity. Cash in the cookie jar: $9.3mm at petition. Ligado needs $115m to “operate smoothly” through the post-petition period, according to Bruce Mendelsohn, head of the financing/capital solutions group at PWP. Fortunately, the debtors hit the courthouse with a prearranged chapter 11 plan: a DIP, a “long-term commercial transaction” with a third party, and a restructuring supporting agreement (“RSA”).

Telecom: it devours cash like a stoner crashing a bag of Doritos. The build cycles are long; companies are at the mercy of regulators, code enforcement officers and environmentalists with eager young attorneys desperate to Make a Difference, or at least an impression on the bosses. Has any industry been more creatively destroyed then re-assembled over the last thirty-odd years? Suppose it’s not some arm of the Law. In that case, it’s innovation (replace copper with fiber), its supply chain, or natural disaster (remember Fukushima? High yield primary was closed for three weeks as doom-mongers warned of mutant fish washing up on the beaches of California) or disasters of human invention. War, or perhaps the nationalization of what V.I. Lenin called the “commanding heights” of the economy. Lenin meant heavy industry – steel mills powered by hydroelectric dams and similar quaint relicts of a vanished age – and media/communications.

This brings us to the amusing observation that Ligado was tipped into bankruptcy by the Department of Defense’s (“DOD”) de facto nationalization of spectrum that the FCC had authorized for Ligado’s use. We’d heard the U.S. military was “evolving” in the general direction of “woke.” Is it similarly “evolving” toward Leninist methods of procurement, e.g., “expropriation”? “Liberation”?

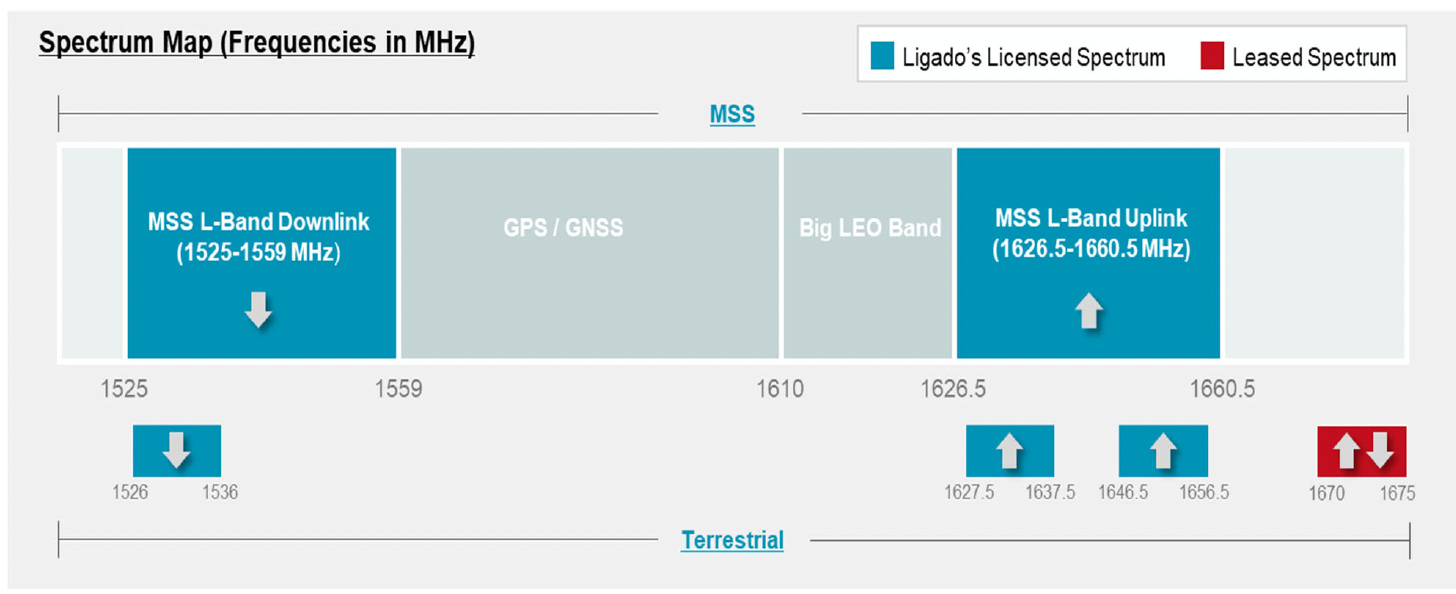

Since 2010, Ligado has sought to integrate its satellite services with terrestrial networks, according to the first-day declaration (“FDD”) of CEO Douglas Smith. Specifically, it’s been seeking authorization to build out a 5G network using spectrums in what it calls the “L-Band,” a “highly attractive one- to two gigahertz (‘GHz’) spectrum category, known as the lower mid-band.” Ligado was nothing if not tenacious. After ten years of a “contentious, protracted regulatory process,”[1] the FCC in 2020 granted Ligado authority to build such a network using its “licensed and leased spectrum.”

Bit of a problem, though. The below spectrum map from Smith’s FDD may be helpful. We wonder if Smith wishes he had never heard of the goddam L-Band. Or, perhaps, he wishes Ligado was not under the aegis of the Department of Defense, the Department of Commerce (“DOC”) and the U.S. Congress “(collectively, the ‘U.S. Government’)”:

The teal-ish box beside Ligado’s 1525-1559 Mhz L-Band is labeled GPS/GNSS. This band is reserved for satellite systems that provide “PNT”: positioning, navigation and timing services. GPS is the “Global Positioning System” owned by the U.S. Space Force (which planet gets invaded first!?!?!). GNSS are the “other” Global Navigation Satellite Systems. Europe’s is called Galileo (such an injustice! Eratosthenes, overlooked again!) Russia’s is GLONASS; China’s is IRNSS, and so on.

The U.S., led by the Department of Defense, has argued since roughly 2018 that Lidago’s use of the L-Band would interfere with the GPS spectrum used by the the U.S. military[2] to “coordinate tactical operations, launch spacecraft, track threats and facilitate air and sea travel.” Yeah, we get that. Say some general needs to extract himself from Kabul ASAP. What if noise from Ligado routed his entourage to the Friendship Bridgeover the Amu Darya River? How those Russians would laugh! And for all we know, noise from Ligado has already farked tactical coordination, contributing to this submarine’s collision with an undersea mountain, this naval supply ship running aground offshore Bahrain, and these two naval vessels almost colliding in San Diego Bay. (Maybe the Elite Human Capital in the Valley can make a Turning Circle app. The old folks did it with pencils, just like the old-school bond guys did repo in their heads.)

Smith argues in his FDD that “scientific studies” show Ligado’s use of the L-Band would not interfere with GPS. The FCC “explicitly rejected” the military’s claims about GPS interference when granting Ligado authority. So what’s the deal? Smith knows the score the Pentagon “has taken the Debtors’ spectrum for the agency’s own use, operating previously undisclosed systems that use or depend on the Debtors’ allocated spectrumwithout compensating the Debtors.”

Emphasis added. “Previously undisclosed systems.” Oh dear. If you ask us, sounds like 48, or some other GWOT agit-prop designed to rattle the populace into believing some “fight them there or we will have to fight them at the Rose Bowl in a way that will utterly ruin college football season” bullshit. The legendarily unaccountable Pentagon, or some entity within the archipelago of three-letter agencies infesting Northern Virginia like a colony of indestructible roaches, has some private war, or God knows what, going on. We assume that, too, is all highly classified. Ligado, through no fault of its own, stumbled into this band, and the FCC, believing it unused, shrugged and told them to take it. So the Pentagon, rather than – we don’t know, tell the fucking truth – reverted to the usual best practice: the tried and true “strategy of deceit and misinformation”(Smith’s words), an array of “unfounded claims” (Smith will not mind if we point out synonyms “lie” and “bullshit”[3]) disseminated like mean-girl gossip among the media and the legislative/administrative branches.

Smith says the DOD and the DOC orchestrated a campaign of opposition which included eight parties filing petitions to reverse the FCC’s 2020 decision. Various U.S. Congresspeople—always ready, willing and able to serve their constituents, especially when the defense of Our Democracy is at stake (and maybe line up a nice gig for when the DC scene gets old) — have likewise objected.

Ligado can’t be blamed for exercising its “rights and remedies” here: in October 2023, it sued the U.S., alleging that the DOD’s bullshit had cost it, Ligado, hundreds of billions in sunk costs and lost profits. $40 billion, to be precise: that’s how much Ligado is seeking in the U.S. Court of Federal Claims (it’s also not very much in light of the Pentagon’s budgets). The U.S., in January 2024, filed a motion to dismiss the suit. In December, the Court of Federal Claims allowed the suit to proceed. The case is

Then there’s the Cooperation Agreement with Immarsat. Immarsat, which also landed a piece of the L-Band, and Ligado agreed to coordinate their respective bits into “contiguous spectrum blocks within the spectrum and at the power levels agreed upon.” Ligado is required to pay Immarsat for those coordination rights. Rather, pay Viasat, which acquired Immarsat in 2021. Ligado has engaged in“extensive discussions” with Viasat about restructuring its “significant payment obligations” under the agreement. Just as the parties were finalizing the contours of a commercial agreement, Smith says, and right out of the blue, Viasat raised up a tax issue that had the effect of sinking the deal. Viasat ultimately“revealed that its true intent is to access the Debtors’ spectrum to implement Viasat’s commercial goals. In other words, without the Debtors’ spectrum, Viasat cannot execute on its business plan.”

What could the company do against such an array of foes? Ligado filed with a DIP and an RSA proposing a pre-arranged chapter 11 and recognition proceeding under the Canadian Companies’ Creditors Arrangement Act.Prepetition funded debt will be equitized, other than the amounts repaid or rolled up by DIP. Equity and preferred interests are retained. As part of the RSA, Ligado is undertaking a long-term commercial deal with AST & Science LLC, a space-based 5G network.

The DIP facility is the standard new money/rollup. It consists of $442m of new money loans, $12mm of which will be available on an interim basis. On the final order, $327mm of “DIP Secured Funding Loans” will be available to repay the 1L first-out, and $103mm of “DIP Delayed Draw Term Loans” (“DDTL”) three days after entry of the final order. The new money loans bear interest at 15.5% cash and 17.5% PIK. The DIP also provides for a roll-up of $442mm of 1L obligations (other than the 1L first-out piece), which can be increased to as much as $497mm[4]. Ligado also seeks the use of cash collateral (the above-referenced $9.3mm).

And those fees! Holy damn, but we assume it reflects the risk of supporting an entity that’s had the absolute cheek to defy the Exceptional Nation; make it mad, and it may smite well smite all the “consenting” investors unto the 70thgeneration. There’s a $20k DIP agent acceptance fee and a $80k annual agency fee. Those are in cash. These are PIK: 12.5% backstop fee, 5% commitment fee, 5% first funding discount fee, 5% second funding discount fee, DDTL funding discount fee (payable on the amount of DDTL draws made on funding date) and a 3% unused funding commitment payable on unused secured and DDTL funds.

As for the AST deal, Smith calls it “transformative” (isn’t that what Gerry Levin called Time Warner’s deal with AOL?). AST gets the right to use Ligado’s satellites, ground assets and L-band Spectrum, “including substantially all of the capacity on SkyTerra-1 and any replacement or follow-on satellites.”AST will pay an annual usage-right fee of $80mm plus a percentage of revenue. Ligado will keeps control of its licenses and physical assets. The deal terminates on December 31, 2107. The implication that the parties believe civilization will survive until then provides a brief glimmer of comfort.

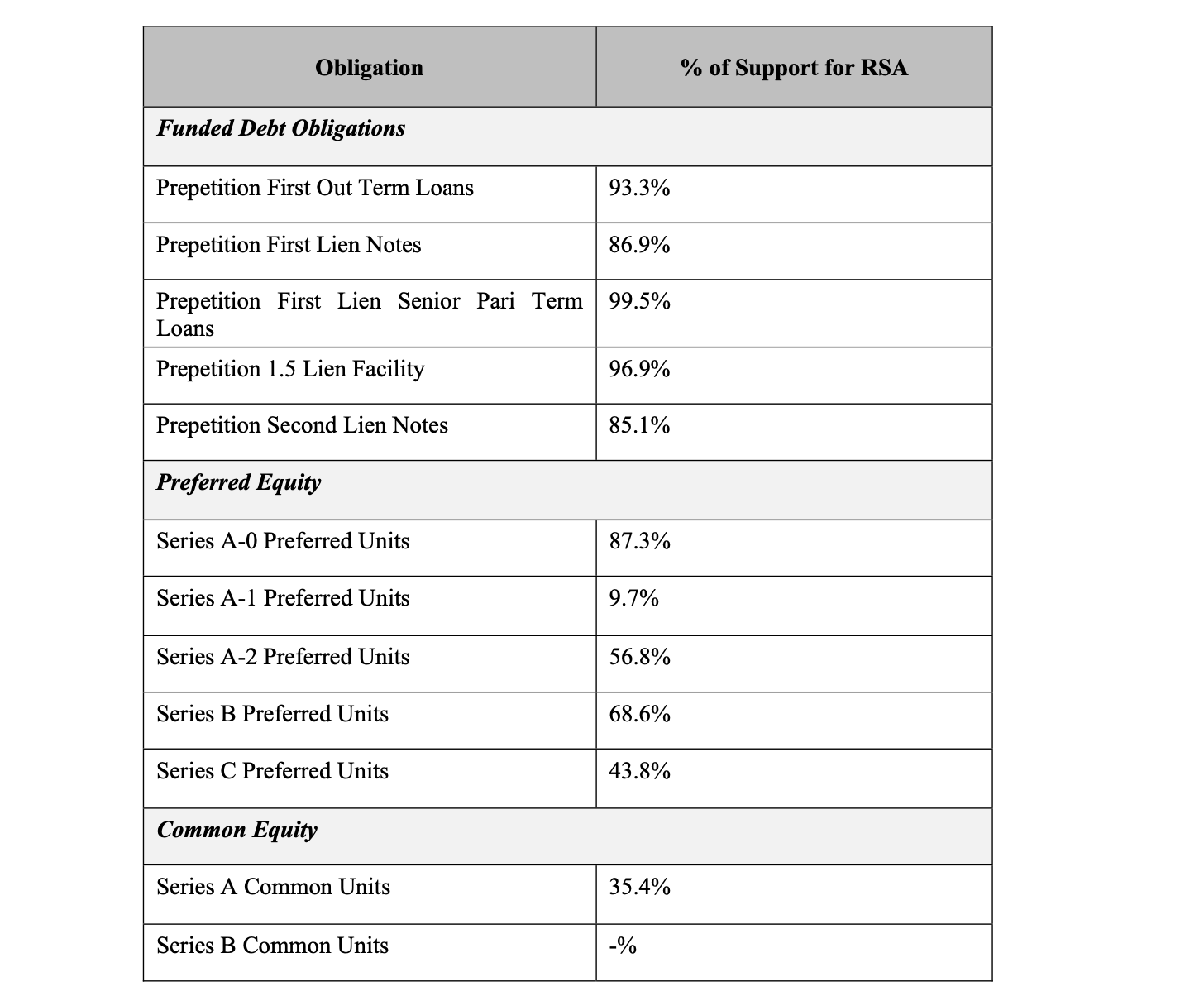

Ligado intends to use the “breathing spell” to pursue its lawsuit against the U.S. government, and here’s hoping that Smith, Ligado and their counsels stick it to the Man, as was said by the hippies of yore. It will also continue working on its technology and document the AST deal. The first-day hearing is today at 2pm ET; we’ll update you afterward. Here are the percentages of support for the RSA:

[1] We realize this is a blindingly obvious statement, but this is why nothing ever gets done in the U.S.

[2] We “took the King’s shilling” (as was the lament of the Redcoats in the days of Wellington) in the days of our youth and have thus acquired the inalienable right of every grunt, dogface, swabbie: to say exactly what we think about the service. Our father, who served as a medic in the Second World War, once said that his views on the U.S. system of governance were conditioned primarily by the Anzio landing and the four assaults on Monte Cassino.

[3] We really hope the U.S. doesn’t trot out Leo Strauss’ “noble lie” bullshit as a plank in its defense.

[4] Here’s a sentence – or is it clause? – Faulknerian in length and Joycean in intelligibility (for those poor souls who didn’t pay $ for the JD or MBA. Those groundlings should be barred from fouling legal motions with their grubby fingers and uncredentialed eyes): “By additional Roll-Up Loans provided by DIP Lenders that provided (or whose affiliate or Approved Fund provided) greater than their pro rata share of the DIP New Money Loans as more fully set forth in Section 2.01(d) of the DIP Loan Agreement), whereby the relevant 1L Debt Obligations (other than 1L First Out Loan Obligations) shall be deemed fully funded and converted into and exchanged for Roll-Up Loans upon entry of and subject to the Final Order, and subject to the challenge rights set forth in paragraph 27 hereof, in each case in accordance with the terms and conditions set forth in the DIP Loan Agreement and all other terms and conditions of the DIP Loan Documents.”